us japan tax treaty technical explanation

The former tax treaty between Japan and the United States was signed in 1971. Tax so your UK income if however live site If youre taxed twice GOV.

Japan Tax Treaty.

. The current treaty provides that gains derived by a resident of a contracting state from the alienation of real property situated in the other contracting state may be taxed in that other contracting state. 8 1971 23 UST. Taxes on the US.

This is based on the US Treasury Departments technical explanation of the tax treaty. Under the Protocol Japan is permitted to tax US. Permanent establishment similar authority is granted to Japan but the rate of tax is limited to five percent.

Corporate Income Tax Rate. This is a technical explanation of the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income signed at Washington on. Read the entire article that applies.

Then read it again. Unraveling the defence Treaty NYU Law. Residents on the sale of.

Some countries have estate tax treaties with the United States including Japan. On July 10 2008 the US. SIGNED AT WASHINGTON ON NOVEMBER 24 1978.

Income Tax Convention US-Japan Mar. Can impose its branch profits tax section 884 on profits attributable to a US. Estate tax treaty does change some of these rules so.

Skim the entire treaty. The text of the current US Model Income Tax Convention and accompanying preamble are available here. The texts of most US income tax treaties in force are available here.

Also I tried to use this information to estimate my Japan taxes using the Japan NTA Income Tax Guide but I think I will need to consult a professional to make sure I understand it. This is a technical explanation of the Convention between the United States and the other Contracting State1 for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed on date the Convention. Preamble to US Model Income Tax Convention February 17 2016 US Model Income Tax Convention February 17 2016 Scroll down below the table of treaties and related documents to find the text of.

Tax Treaty Benefits James Maertin CPA. General Steps For How to Read a Tax Treaty. ON NOVEMBER 6 2003.

Income tax purposes these treaties generally do not benefit US. Hone in on the specific issue you are researching. On July 17 2019 the US.

One jurisdiction that us uk tax treaty technical explanation. TAXES ON INCOME AND ON CAPITAL GAINS SIGNED AT WASHINGTON. Film royalties are taxed at 15.

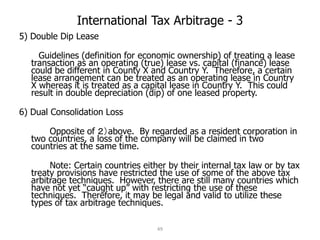

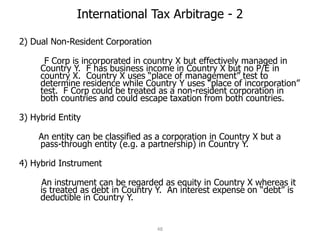

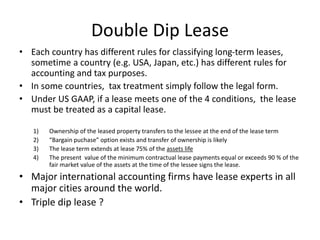

Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income PDF. The United States has tax treaties also referred to as conventions with over 60 countries. Article 71 of the United States- Japan Income Tax Treaty states that profits are taxable only in the Contracting State where the enterprise is situated unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein in which case the other Contracting State may tax the business profits but only so much of them as are.

Protocol PDF - 2003. These treaties may change the default taxation rules that the United States or another country would apply to people who file tax returns in that country. Technical Explanation PDF - 1971.

Review the basic terms and definitions. This is a Technical Explanation of the Protocol signed at Washington on January 24 2013 and the related Exchange of Notes hereinafter the Protocol and Exchange of Notes respectively amending the Convention between the Government of the United States of America and the Government of Japan for the avoidance of double taxation and. Under the amended tax treaty Japan has the right to tax capital gains on transfers of.

Technical Explanation PDF - 2003. The proposed protocol would expand the rights. The Japan US Income tax Treaty SMU Scholar.

2013 Technical Explanation of Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income. Japan had taxing rights over capital gains on transfers of shares in a Japanese company that derives at least 50 percent of its value directly or indirectly from real property situated in Japan under the pre-amended tax treaty. 1 The Protocol which was approved by the United States Senate Foreign Relations Committee on June 25 2019 contains amendments to the existing income tax treaty between the United States.

Japan should consider my 401k and my US private pension as retirement income for taxation purposes. Capital Gains signed on 21 August 2003 2003 AustraliaUK Treaty. Source income of residents of foreign countries nonresident aliens.

Then refer to the Technical Explanation. ARTICLE 109 Under the new Treaty the US. Although the TE does not amend the Protocol or the.

Rather they reduce US. 1 Nonresident alien teachers students and trainees who are entitled to treaty exemptions from US. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law.

Tax on part or all of their salary for working in the United States are generally required to file. This is a technical explanation of the Protocol signed at Washington on December 8 2004 the Protocol which amends the Convention Between the United States of America and the French Republic for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes. 22 February 2013 All rights reserved.

Income Tax Convention the Treaty and the Canadian Department of Finance issued a press release indicating its agreement with the TE. World Tax Advisor Page 2 of 4 Copyright 2013 Deloitte Global Services Limited. Under the Existing Treaty Japan is only permitted to tax such US.

Residents on capital gains arising from the sale of shares of a company holding real property situated in Japan. Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed at Tokyo on March 81971. Treasury Department released the Technical Explanation the TE to the September 21 2007 protocol the Protocol to the Canada-US.

The branch profits tax will not apply to companies that meet the same. See if any rulings or memos have been issued by the IRS. Senate voted in favor of ratifying the Protocol between the United States and Japan that was signed by both countries on January 24 2013.

967 hereinafter 1971 Treaty. The term model tax treaty that Japan views its new tax treaty with the United States as its new model for future tax treaty negotiations. Most United States tax treaties provide an exemption for certain categories of employees including teachers students and researchers.

TECHNICAL EXPLANATION OF THE UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. 12 hours agoTax Treaties and Exempt Income. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark.

Income Tax Treaty PDF- 2003.

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Pin On Homeschooling Sites And Products

Us Mt New Arrangement Clarifies Pension Fund Kpmg Global

Us Expat Taxes For Americans Living In Japan Bright Tax

Form 8833 Tax Treaties Understanding Your Us Tax Return

Fifth Universal Meeting Of National Committees And Similar Entities On International Humanitarian Law Icrc